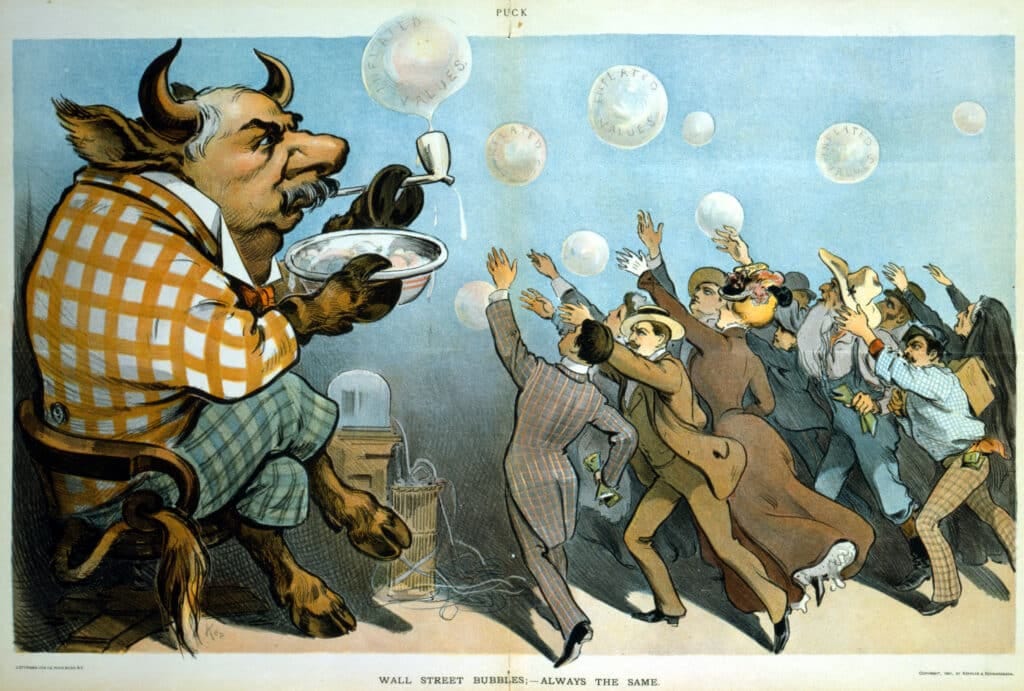

The Story of the Seven Dwarfs Mining Inc: How the Coronavirus Masked the Corporate Debt Bubble

A Fairy Tale a how Covid Stimulus prevented a Debt Reset

Introduction

Before the coronavirus, a false narrative arose that the economy was healthy, as measured by:

growth in the stock market and a

reduction in the unemployment rate

when in fact the recovery from the 2008 financial crisis was weak and the facade of strength was masked by low-interest rates which enabled governments, corporations, and individuals to achieve the illusion of prosperity through increased borrowing.

But there is more to the economy than the stock market and unemployment rate. The bond market is larger and “smarter” than the stock market. When assessing the pre-coronavirus economy, one must also take into account the stagnant profits

corporations disguised by borrowing in the bond market to fund purchases of their own stock, artificially inflating the stock market.

Like an Injured Athlete taking Pain Killers

The US economy was like a professional football player who had been “playing hurt” for many years.

The economy used debt like the football player uses pain killers. The debt masked the economy’s problems

and allow it to perform at a higher level than otherwise would have been possible hadpain-killersnot dampened the brain’s ability to perceive reality. But unfortunately, an economy is not like an athlete in that it can’t retire at the end of a 15-year career.

Featuring: The Seven Dwarfs

The story I’m about to tell is intended to illustrate how corporations borrowed money and then used that money to buy their own stock, inflating the stock price.

In finance jargon, this is called “leveraged stock buybacks”. Corporations have used stock buybacks as a major strategy to boost their share price but many corporations didn’t have enough profits to buy back their stock because the overall level of (pre-tax) corporate profits has been flat since 2012.. While some companies may have been able to legitimately afford to buy their own stock with real profits, over 50% of those buybacks were done using borrowed money.

In fact, if you look at who had been the buyer of most of the stock purchases in 2018 and 2019, it had mostly been the companies themselves purchasing their own stock, not pension funds, individuals, or hedge funds.

I illustrate how this market manipulation works using a fairy tale featuring the seven dwarfs and their mining company “7 Dwarfs Mining, Inc.” Early in the story, the dwarfs seemed to have discovered an easy way of making money until an unforeseen emergency struck and disrupted their carefully laid plans.

It is commonly known that emergencies reveal.

This story illustrates what emergencies can conceal.

The Founding Members:

Once upon a time, the 7 Dwarfs Mining company was founded in a small Forest Kingdom town by Seven dwarfs:

Dopey,

Doc,

Bashful,

Happy,

Grumpy,

Sleepy, and

Sneezy

After a number of years in business together, the mining company was valued at $7 million

and generated$700,000 in profit per year, which they split 7 ways.

Assets# of SharesYearly ProfitProfit per ShareDebt$7 million7$700,000$100,000$0

Going Into Debt to Hide Flat Growth

One year, Grumpy decided he was unhappy in the mining business. Perhaps this was due to his sour attitude, or perhaps he was feeling blue because the mine’s profits had not increased at all in the previous 6 years.

Grumpy decided to sell his share in the mining company, but there were not a lot of other dwarfs that wanted to buy out his stake at the price of $1 million.

The other 6 dwarfs in the company wanted to continue in the business but they didn’t have the cash to buy out Grumpy, so they decided to borrow the $1 million from the bond market. Interest rates were low in the Forest Kingdom because the economy hadn’t fully recovered from the previous debt-fueled financial crisis a dozen years prior.

The kingdom’s treasury secretary’s belief thatlow-interest ratesstimulate growth was also a factor in setting the interest-rate climate.This easy lending environment allowed the dwarfs tosucceedin borrowing $1 million at an interest rate of3% per year.

The Dwarfs’ Epiphany: Earnings per Share

After Grumpy exited the company, the 6 remaining dwarfs renamed their business: “6 Dwarfs Mining, Inc“. The total value of the company (market cap)

was still $7 million and they split the same $700,000 profitsix waysinstead of seven. This resulted in profits of$116,666/share, a16.7% increaseover the prior year. Grumpysulkedfor the next year and a half about missing out on the share price increase his exit had created, but Dopey reminded him that it was his own idea to leave. 🙁

(Note: I’m abbreviating “million” as “m” to save space in this chart.)

Upon learning of this increase in EPS (Earnings Per Share), the 6 remaining dwarfs were elated! By taking on debt to buy out Grumpy’s stake, they managed to reduce their number of shares, thereby achieving their first share price increase in 6 years! Things were looking up! **

** “Earnings per Share” were up even though the Dwarf’s equity in the company was down.

Setting Dopey’s Debt Plan in Motion

Bashful was known to wear his heart on his sleeve, especially if he had romantic feelings for someone.

So the next year, after Bashful’s most recent crush departed the village, Dopey encouraged alovestruckBashful to retire from the company and follow his sweetheart to the neighboring Mountain Kingdom to the North. Dopey wanted toreduce that number of shareholdersin the mining company because he had learned the benefits of havingfewer shareholdersfrom Grumpy’s exit, even if that comes at the expense of havingmore debt. He calculated thatsplitting $7 million five wayswould result in a share price of $1.4 million per share. This would bea 40% increaseover the original $1 million share price, although the company’s profit was still thesame $700,000per year.Once again, the dwarfs went to the bond market and usedborrowed money— an additional $1 million dollars — to buy out one of their fellow dwarf’s share.

After the successful payoff, Dopey said to Doc: “Wow, this debt thing is really an easy win. A few years ago we were struggling with plans to make efficiency improvements to the mines but that would have required us to invest some of our profits into new machinery, research and development, and employee training. Instead, I only needed to identify the key to Bashful’s heart and use some accounting wizardry

to increase our share price the “easy way” — with more debt.”

Following the Plan

Dopey had a reputation for harebrained plans, but he knew that Sleepy’s drowsiness was no reason to doubt his intelligence or acumen.

Dopey concluded that the two things that would most motivate Sleepy to sell his share were the attraction of sleeping in until noon and abonus of $100,000,so he struck up a conversation with Sleepy on these two themes when the two had a private moment together. The next year, Sleepy was enjoying a restful retirement in the tropics and the mining company had one fewer shareholder.

The pattern continued again the following year with Happy given a $150,000 bonus contingent on his retirement, causing the share price to rise to $2,333,333 (a 133% increase). All the remaining dwarfs were extremely happy at this turn of events, as was Happy himself. 🙂 Dopey took out a loan to buy a red Ferrari with the vanity license plate “Debt King” in anticipation of his upcoming buyout. Yet, at the same time, the company’s total profit remained the same $700,000 per year it had been originally before Grumpy exited.

(Note: These figures are simplified. They do not include reinvesting profits or interest charges on the debt.)

A Declining Credit Rating

One of the unnoticed consequences of Dopey’s plan was that the mining company’s credit rating began to deteriorate as the company borrowed money in the bond market. The company was effectively agreeing to devote some of its future revenue (i.e. paying interest on the additional debt in the future) in exchange for a higher earnings per share today. Before Grumpy exited, the company had a AAA credit rating, but as Bashful, Sleepy, and Happy’s shares were bought out, the company’s credit rating fell to AA, then A and now stood at BBB, the lowest investment grade.

Dopey was warned that if the company was assessed another credit downgrade the company would fall to a non-investment grade status (often referred to as “junk” bond status

). Were that to happen, pension funds and many investors would no longer be legally permitted to own the company’s debt and theinterest rate the dwarfs would have to pay would spike higher.Dopey calculated that there was ahigher riskto the company’s finances in the coming years, but he figured that would be Doc and Sneezy’s problem, not his, because he,Dopey, planned to be the next dwarf to exit.After Dopey left the companyhis financial interests would be separate from the mining companyand he would not longer care if the company should happen to suffer losses.

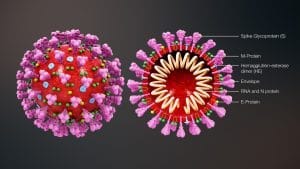

The Unforeseen

The number of shares now stood at 3, with Dopey, Doc, and Sneezy remaining, when something unforeseen happened — a sickness called Rapidico took hold in the neighboring kingdom of Achin. As the illness reached the cities of the Dwarfs’ Forest Kingdom the advisors to the kingdom’s Queen — Queen Elizabeth II’s

privy council—recommendedthat the kingdom go into lockdown to prevent the spread of the disease.

The Response

A lockdown seemed like a radical idea and one that the queen deferred to individual provinces.

As other provinces of the kingdom went intolockdown, Dopey, Sneezy, and Doc weredismissiveand continued business as usual at 3 Dwarfs Mining, Inc.

A month and a half later, an outbreak of Rapidico took place at 3 Dwarfs Mining, Inc., set off by an asymptomatic Sneezy. Dopey later recalled, “Sneezy is always sneezing; I didn’t think nothing of it.” But the tight quarters of the mine proved to be fertile ground for the contagion to spread and many mine workers were infected. True to his name, Doc threw himself into the job of treating the afflicted dwarfs and heroically saved countless lives, but the mine’s production ground to a halt nonetheless. Other businesses were similarly affected and the queen was forced to move beyond her earlier deference to provincial autonomy and call for a strict quarantine.

The Divided Kingdom

Because the Forest Kingdom was so fractious and the forest creatures so impatient, financially vulnerable, and headstrong, not all parts of the kingdom followed the queen’s orders closely. This disunity among the provinces resulted in stubborn pockets of disease in the lagging parts of the kingdom which hampered the economic recovery.

The length of the quarantine caused heavy losses to the 3 Dwarfs Mining, Inc., requiring them to borrow more money. Of the original $7 million that the company had started with, the 3 Dwarfs Mining Inc had only $3,638,841 equity left ($9,846,549 assets – 6,207,708 debt)

because they had borrowed in the bond market to buy out the shares of Grumpy, Bashful, Sleepy, and Happy, resulting in adebt of $6,207,708.

The Risk and Reward of a High Leverage Ratio

Companies can choose how much risk they want to take to accelerate growth (Risk vs Reward). The use of debt is a key contributor to the speed at which a company can grow but it also increases the risk that the company will falter should an unforeseen risk arise.

In this particular case, the leverage ratio

I’m comparing is the ratio of market capto debt. Notice how theLeverage ratioincreases as thenumber of shares(or equity) decrease. Reducing the equity, in this case, increases the leverage ratio (7/2 = 3.5), which increases the profit per share.

Notice how the profit per share increases as the leverage ratio increases.

Note: This chart has been simplified

When Dopey planned to exit, the share price would have risen from $1 million to $3.5 million on the leverage ratio alone. A more complex calculation that reinvests profits each year would have the original $1 million share price to rise to $4,923,274, not including a bonus of $200,000, which would leave Dopey with a total exit package of $5.1 million dollars!

When things are going well, leverage has the effect of multiplying a company’s earnings per share by the leverage ratio. But when an unforeseen tragedy hits, it leaves companies with less of a cushion to ride out a storm.

The “Debt Bomb” Goes Undiscovered

There had been a concern before the Rapidico virus hit, that a large number of Forest Kingdom companies had also been following Dopey-like plans to increase their share price the easy way — through financialization — that is “financial engineering” that inflates share price but does nothing to improve labor productivity. In the 7 Dwarfs Mining Company, the profit doesn’t grow at all, but EPS (earnings per share) still goes up anyway because the number of shares goes down. The shareholders retain ownership in the company, but often with higher levels of debt.

Resetting the “Debt Bomb”

The result is a potential “debt bomb”

where a buildup of debt can threaten the whole economy. The companies contributing to this “debt bomb” reportshare price growth, but this “growth” isartificialbecausetotal profits are flatand earnings per share growth are only made possible bytaking on more debt.When the debt bomb explodes (or pops like a bubble) it threatens to spill over into the broader economy, threatening the whole country, not just the borrowers.

The Rapidico crisis had given the government the opportunity to blame some of the kingdom’s problems, which had been years in the making, on the Rapidico virus and the country of Achin, even though a significant part of the financial problems were the fault of the kingdom’s systemic dysfunction. Had the kingdom not already experienced a financial crisis a dozen years prior, and had there not been such low interest-rates, the Dwarfs would not have taken on so much debt, leaving their mining company financially vulnerable in a time of crisis. Had the Rapidico crisis not happened, such debt dysfunction was bound to lead to another recession anyway and leave the kingdom to grapple with questions about the authenticity of the prior decade’s growth.

Debt for Productive Purposes?

When some of the queen’s more intellectually self-critical advisors speculated that it would have been better had the Forest Kingdom’s companies invested the money they borrowed into productive assets rather than share buybacks, others replied that too few workers could afford to buy

what the companies would have produced.

Sweeping it Under the Rug?

A lone advisor commented that the prior 6-8 years of flat profits

during supposed “good times” boded poorly for future growth prospects. “When was the last time we’ve generated substantial growth without a lot ofdebtand thecreation of another artificial bubble?”, said the deputy finance minister. Many advisors agreed with her, but were hesitant to break the bad news to the public. Nevertheless, all agreed that the queen’s legacy depended upon her taking steps to prevent such adebt bombfrom re-emerging and requiring yet another bailout. Youmightbe able to affordthisbailout, but we haven’t done anything to pay down the debt from the previous financial crisis and we certainly can’t afford to makebailouts the norm. Next time, her advisors said, you won’t have theRapidicovirus toblame for the bailoutand you won’t be able tosweep all that debtunder the rug.

Will the Dopey Financial Plans Stay Concealed?

“I know great nations face their problems, rather than distract the public with diversions,” said the queen,

but a financial crisis is no time to address deep weaknesses within the economy. Calling attention to the country’s debt dysfunction willonly erode consumer confidencewhen we need it most. Besides, many of the Debt-Dopies are particularly crafty and hire former members of parliament as their lobbyists! Another bailout isinevitable. It is better for me tolet the “Debt Dopies”remainconcealedby the wider bailout,for now, encourage optimism about the economy’s revival, and let someone else deal with the problemlater.”

To repeat my opening statement:

It is commonly known that emergencies reveal.

This story illustrates what emergencies can conceal.